How to Choose a Good Property to Live in.

Announcement

In this article, you will know, how to choose a good property to live in. So you're looking for a place to live, but you still have some doubts. Calm down, we will help you with some important tips on this topic that many people doubt.

Surely, you have already seen, or someone has already told you, the phrase “whoever gets married, wants to get married”, right? The dream of having a home does exist and must be respected. But first you need to know your profile.

Announcement

However, in a country with so many difficulties, living in your own home is indeed an achievement. However, it is worth highlighting.

The challenges.

Challenge often seems to be the chosen path to achieve this goal. Especially if we think:

Announcement

- Most Brazilians are unable to save money.

- Due to lack of knowledge and interest, few people know how to choose the best option.

- Living in your dream home seems to be a stigmatized issue. But in reality, you need to know how to choose the best one for you.

Therefore, how to choose a good property to live in, you must be cautious. And the execution of all this in the financial organization in life. Let's deal with this today.

How to Choose the Property.

Another very common phrase to hear is “Rent is money that is thrown away and will never come back”. Have you ever heard someone say that? But this is just something that the person has formed in their mind.

It should be noted that there is no return on the money spent, which is not the point. The problem is deeper. The right question is: will your decision and attitude today bring you closer or further away from realizing your dream?

Is your dream to be able to travel? Professional growth? Maybe change city or country? Do you still have your own house?

However, all of these factors must be considered when making a decision like this. In fact, anyone who thinks that rent will definitely delay their dream of owning a home is mistaken.

Renting can be part of a plan, which, if well planned, will lead to you buying your home. Therefore, you just need to calculate your steps well.

Furthermore, at the current level, if I put money down, is it worth renting? Maybe not. Shall we understand all this better?

What do the numbers say.

So suppose you want to buy a property worth R$ 200,000.00, at an annual interest rate of 20%, and the total effective cost per year is 7%.

For this example, we assume you have R$ 50,000.00 for the down payment. And R$ 10,000.00 for the transaction cost.

In other words, you have R$ 60,000.00 available, which can also be used, if you choose to rent a house, until you can save more money. So which is best?

Analyze the Numbers To Choose a Good Property.

For this example, the most expensive installment (SAC table) is R$ 1,473.12.

Renting this same house costs an average of R$ 800.00 per month.

Therefore, if you can afford the financing part, it means that you should also have the energy to save R$ 673.12 per month when choosing the rental.

Also, we need to consider some variables to correct the value of the property over time, the rent and the profitability of the investment in terms of rent:

- To increase the value of the property, we believe that the IPCA is 3.5% per year.

- For rent adjustments, the average IGPM in recent years is 6%.

- The profitability of investing 0.3% of funds per month.

Therefore, given this situation, financing is more interesting than paying rent and saving on installments. Check the numbers:

- Taking into account entries, expenses, financing amount and interest, total amount paid: 312,198.76 reais.

- Among them, 102,198.76 reais are interest.

- The IPCA updated the value of the property after 20 years: R$ 399,580.13.

And investment? With a monthly return rate of 0.3%, your money is paid very little, so you won't be able to collect enough money to buy in cash.

If the monthly rate of return is greater than 0.9%, considering other variables, the account is beneficial, which is quite difficult today. But it's not impossible, with a little study you can do it.

What Can We Learn From Numbers?

First of all, everything you learned here previously is part of a simulation. The simulation looks like this: the variables in the formula.

Well, but simulation is also very important. And truth. The basic lessons from this exercise are:

1. Inflation needs attention.

The inflation rate or percentage, used as a reference for evaluating the property, will greatly affect your final equity (purchase) and the real profitability of the application (rent). Many people exaggerated their property predictions, and we know that Brazil is a country of ups and downs.

2. The percentage used for rent adjustments is also critical.

The greater the potential for real estate appreciation (purchase) and return on investment (rent), the greater the advantage of financing instead of renting at low interest rates.

3. If you choose to rent, the difference between the maximum installment amount and the rental amount may be different.

In other words, if you choose to rent a house in a simpler location and have greater savings potential, over time, this could be a good way to save and raise more money.

4. Pay attention to the input.

Even though the choice of financing is advantageous, it is important to realize that there is another crucial factor called “down payment”. Therefore, it is important to save money to provide as much down payment as possible.

5. Selic rate can change the entire simulation.

If it rises again, the total effective cost of financing (CET) and the return on conservative investments also increase. This can change the final bill and benefit the leasing program for a period of time.

However, the main lesson is that you shouldn't limit yourself to simulation and don't want to repeat the simulation every time something changes.

The most important thing is to have good financial planning throughout your life to make an informed decision.

Therefore, the impact of the choice (financial or rent) needs to be known and absorbed without major budget problems.

I say this because choosing a 20 to 30 year loan means you have to spend money during that period.

Between us, we also know that 20 to 30 years doesn't go by that quickly!

Choosing a Good Property is a Subjective Decision.

The decision to buy or rent also has a very strong emotional aspect, which goes beyond the numbers.

For many people, having their own home, even if it is financed, gives them peace of mind that money cannot buy.

Therefore, do not think that such a decision is just a mathematical decision as it will affect your happiness, relationships and even your family.

Each person, couple or family has their own needs and goals. Additionally, the city you want to live in may bring some variables.

As a dream, many Brazilians start by buying a lot. Afterwards, they will raise funds and FGTS to build houses in the future.

On the other hand, in big cities, finding land may not be so simple. In this case, the cheapest and most common alternative may be to buy an apartment that is still off-plan.

Of course, the path to buying a home will bring a small victory, which is also essential for maintaining motivation.

Making the Right Decision.

If you decide to buy a property but pay rent today and don't understand what is discussed in this article, take a deep breath and stay calm.

Now it's time to understand that you need financial education and start controlling your budget better.

Define the type of house and the desired location. Then look for values. Knowing exactly how much money you need makes planning easier.

Additionally, learn to save money regularly to offset at least the minimum down payment on your mortgage.

Remember: don't make any decision out of fear. When we talk about the most expensive asset acquired in our lives (our own home), this can be disastrous.

To complete.

Learning to do math is great, but math alone cannot solve the problem. It's best to know that many variables are not completely predictable.

Therefore, planning modestly is the key to starting to question the financing or rental that is best for you.

After better planning and in-depth study of the concepts involved in each alternative, some calculations are carried out with the help of experts.

Finally, talk to your family and take time to decide. Good luck!

Latest Articles

Gym Training Apps

Advertisement Training for the gym becomes more effective and engaging with the help of specialized applications. These digital tools offer everything from...

SBT Vídeos app: Watch SBT Soap Operas

Advertisement The SBT Vídeos App revolutionizes the way we watch television, bringing the best of SBT soap operas directly to...

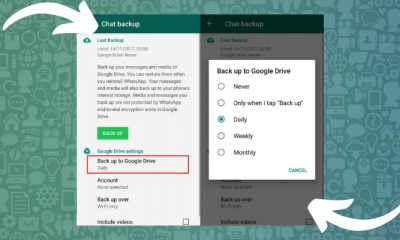

How to Restore WhatsApp Backup

Advertisement Restoring WhatsApp backup is a crucial skill in the digital age, especially when we consider how often we use...

Meditation Techniques that Reduce Daily Stress

Advertisement Meditation techniques have gained prominence as an effective solution for managing daily stress. In a world...

How to Recover Old Contact Numbers on Cell Phone

Advertisement Recovering old contact numbers on cell phone may seem like a challenging task, especially when the contacts are essential for...

Improve Your Fishing Using These Apps

Advertisement Improve your fishing by integrating technology into your favorite hobby. The digital era has brought innovations that transform traditional activities, such as...

Glucose Monitoring Application

Advertisement Glucose monitoring is essential for millions of people around the world, playing a crucial role in...

How to Request and Download a Free Digital Driver's License

Advertisement Requesting and downloading a free Digital CNH has never been so accessible. With the digitalization of DETRAN services, this...

Time Management Apps

Advertisement Time management is a crucial skill in the digital age, where distractions are always within reach. In this context,...

Educational Apps for Children

Advertisement Educational apps for children are indispensable tools in the digital age, promoting fun and interactive learning. By combining technology...